We've all seen them: long freight trains loaded with brand-new cars. They're what comes to mind when people think of car transport by train. Cars have been transported by rail like this for decades. Around 250 freight trains travel across Europe every day in DB Cargo's network, carrying both finished vehicles and components. This now also includes e-cars and their components, as the automotive industry is in the midst of change and DB Cargo is supporting the transformation as a logistics partner.

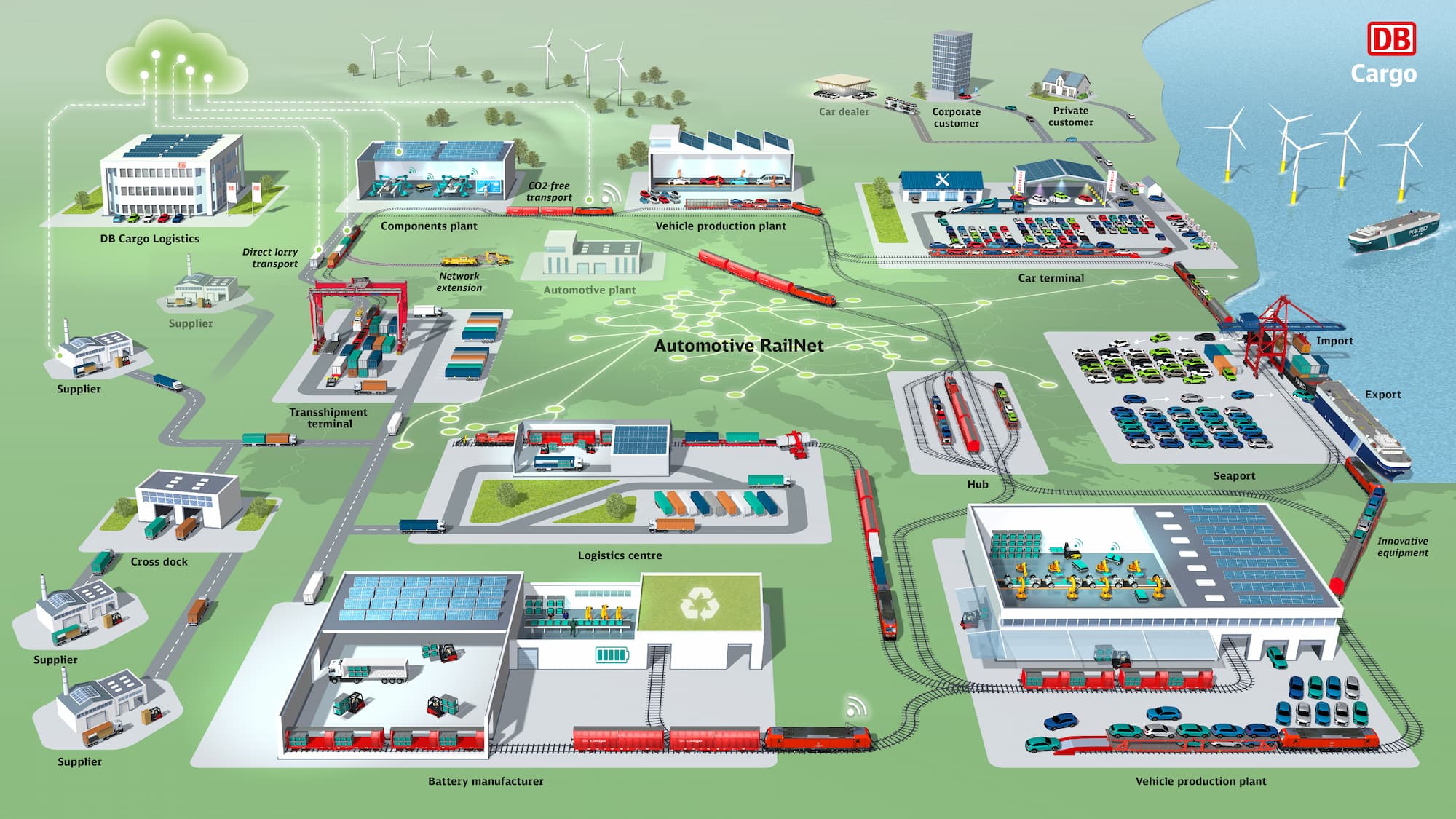

The backbone of automotive logistics: the Automotive RailNet

What do you do when there is an enormously high demand for transport in an industry, but the shipment structure means that it cannot be mapped in its own block trains and single wagonload transport is not fast enough? You set up an industry-specific rail system, making it easier to get started and continuously develop it further in the interests of the customer. That system is the Automotive RailNet and it has been providing efficient rail transport for the entire European automotive industry (both vehicle manufacturers and suppliers) for over 20 years.

Europe-wide network from a single source

The Automotive RailNet from DB Cargo Logistics, a subsidiary of DB Cargo, offers customers the best of both worlds: the speed and efficiency of block train transport and the flexibility and scalability of single wagonload transport. "Rail freight transport and automotive logistics weren't an ideal match before, so a lot of things were transported by lorry," recalls Kai Birnstein, Head of Automotive. "After connecting private sidings in the first step, later we connected multimodal rail access points such as logistics centres, railports and transhipment terminals. We also integrated formation yards, which we call hubs, into the network. They're smaller and faster than the big marshalling yards. We added strong partners for the last mile to this rail network and developed door-to-door solutions, with rail making up the main part and lorries taking care of the first and last mile. We've increasingly taken on the role of lead logistics provider." This approach links automotive clusters together and also connects the major seaports for import and export.

Automotive industry in its biggest disruption ever

The automotive industry is at an unprecedented turning point. The transformation to electric cars is causing far-reaching changes that are also affecting logistics. "Vehicle production is going to change drastically," says Birnstein. "With around 80%, combustion engines still make up a clear majority, but that figure is expected to fall below 30% by 2030. The gearboxes still in use today will be history then, and the market will be dominated by components like batteries." And since they're large and heavy, weighing several hundred kilograms, those batteries are predestined for transport by rail. Transport by lorry is not the first choice, especially given the quantities needed; a freight train replaces up to 52 lorries while cutting CO2 emissions by around 80%. So in terms of eco-friendliness alone, rail freight transport is therefor the more suitable option, and it minimises the carbon footprint of every electric car. Safety considerations also clearly favour freight trains, which is why well-known manufacturers and suppliers already rely on DB Cargo's expertise when it comes to battery logistics.

Plug-and-play battery transport

With the transformation, new manufacturers are entering the market and new components such as batteries and battery modules need to be transported. Most batteries still come from Asia, but that will change in the future. Battery production facilities for electric vehicles manufactured in Europe will also be sited here, and DB Cargo Logistics is already at work integrating these new facilities into the Automotive RailNet. This is where the network's strengths pay off. "With our plug-and-play approach, we can keep the network open to new manufacturers and suppliers and react to new trends, cargo streams and sites at any time. You could say it's a breathing system," says Dr Jan Daniel, Head of Product Management. "By using a wide range of rail access points and our hubs, where we efficiently assemble and route individual trains, additional companies can attach themselves to our highly integrated network between the automotive clusters at any time, even without a private siding. Our network makes us able to take action in this volatile, changing industry at all times. We are and always will be the 'conductors' of the overall 'orchestra'."

The work starts long before the first trip

As the "conductor", DB Cargo Logistics takes an active role at an early stage, helping customers consider rail connections while planning their factories because infrastructure is designed at the beginning and is difficult to change later. "Having your own private siding is still the most efficient solution," says Birnstein. "If customers decide not to pursue that option, we look for other options that enable efficient and flexible logistics close to the facility. For example, we have our own logistics centres for transporting components and compounds for distributing finished vehicles." This kind of full-service consulting will remain an important task in the future as both suppliers and the car manufacturers themselves are looking to move from Asia to Europe.

Taller, heavier, wider: new equipment for new vehicles

The transformation is also exciting in terms of the equipment it calls for. For example, batteries can be transported safely and quickly by rail on special racks in sliding-wall wagons, and there are special car carrier wagons for finished vehicles. But the market's needs are changing. Cars have been getting ever wider and heavier since SUVs became the most popular models, and electric cars are also playing a part in the modernisation of DB Cargo's freight wagon fleet: their batteries make them heavier than traditional cars. "We're constantly converting existing equipment and expanding our fleet with new flexible double-deck wagons so that we're prepared to transport the cars of tomorrow," Birnstein says.

In addition to procuring new wagons and converting existing ones, new strategies with more efficient round trips and reloading are needed, and they're being implemented in the Automotive RailNet. Goods flows are being analysed, new logistics strategies are being developed, and the network is being adapted accordingly.

Other trends in the automotive industry

DB Cargo sees the ongoing transformation not as a risk but as an opportunity to shift more freight to environmentally friendly rail transport. With this in mind, the Automotive RailNet is proving to be an ideal and flexible backbone for automotive logistics that will both help with the transformation and shape the future.

Get in touch with our expert.